Metric of the Month: Invoices Billed to Customers With Credit Terms

Choices to prolong or withhold credit history can be difficult to make at any time and in any economic system. In a international pandemic and economic downturn, these decisions can be even extra difficult as businesses struggle to take care of dollars movement and hold the lights on. Every single company needs to provide new shoppers in the doorway and generate gross sales. But carrying out so in a way that doesn’t eventually hurt the organization calls for sensible, considerate plan and a willingness to acquire some possibility.

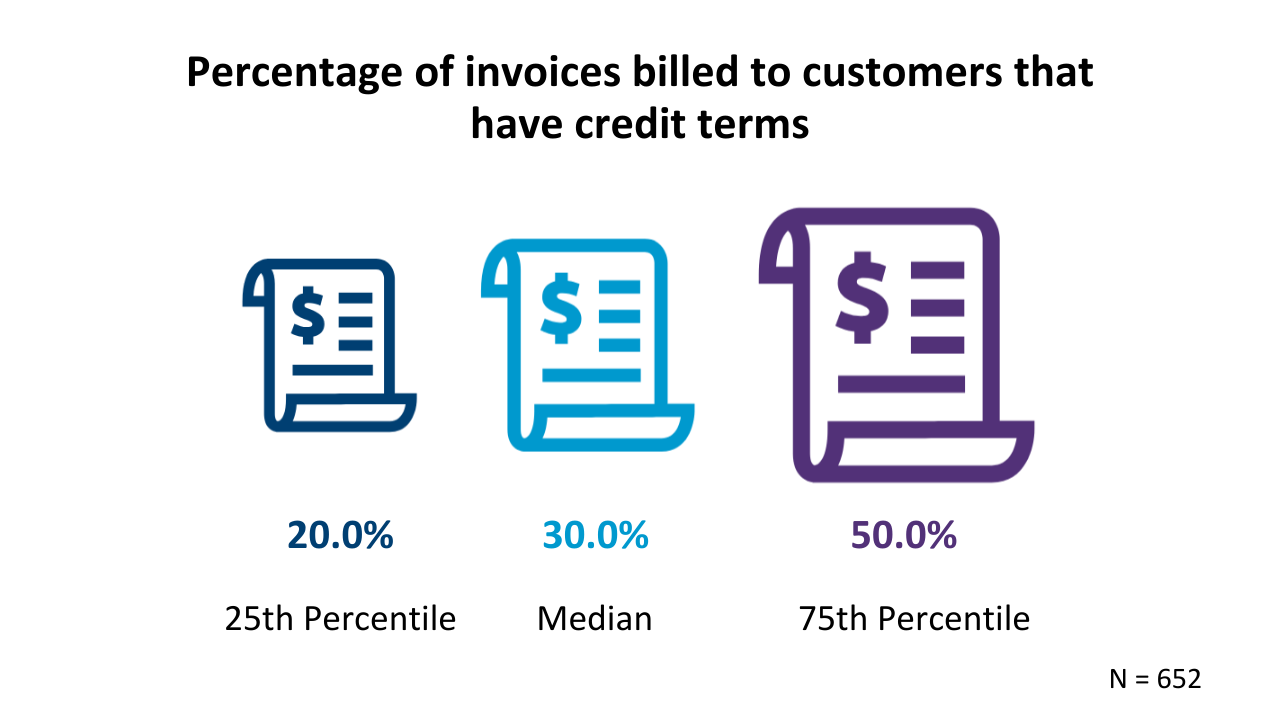

The quantity of credit history that firms provide can fluctuate rather a little bit, based on field, dimension, and economical strength. By way of its Open Benchmarks Benchmarking General performance Assessment in Client Credit and Invoicing, APQC finds that respondents offering the the very least quantity of credit history (individuals in the twenty fifth percentile) invoice 20% of their invoices to shoppers with credit history terms. Respondents in the 75th percentile are a minimal extra than two times as generous with their credit history, billing fifty percent of their invoices to shoppers with credit history terms (see graphic).

This cross-field benchmark consists of a broad vary of firms, but some industries are by natural means extra credit history-significant or credit history-averse. For example, handful of shoppers — particularly in a pandemic and economic downturn — will stroll into a motor vehicle dealership with the dollars on hand to pay the entire price tag of a car or truck at the position of sale. It so would make sense that automotive respondents at the 75th percentile invoice 83% (or extra) of their invoices to shoppers with credit history terms.

Meanwhile, the wellbeing care field is frequently less adaptable about credit history, generally requiring payment upfront for treatments. Health and fitness care respondents at the 75th percentile invoice only 30% of invoices to shoppers with credit history terms. As often, we recommend that you benchmark this and other actions inside of your field for a sharper photograph of where you stand relative to peers and competitors.

Weighing the Positive aspects and Challenges

At a broad amount, credit history decisions call for a fragile balancing act. Credit policies that are also lenient may well expose a company to undue possibility with greater numbers of shoppers unable to pay. Policies that are also restrictive, on the other hand, also have possibility simply because they may well freeze out shoppers that normally would have experienced the means to pay with credit history terms. Each and every company desires to weigh the rewards and tradeoffs towards factors like possibility urge for food, strategic objectives, and economical strength. Finance leaders ought to keep on being cognizant of the pros and downsides of extending credit history as they do the job by means of individuals decisions.

Benefits of Extending Credit

Credit applications can do the job to a company’s edge, supplied that the system is backed up with a considerate plan. If you can afford it, the additional payment selections created offered by means of credit history terms can open the doorway to new shoppers by earning it much easier to obtain the solution or service. Extending credit history can also generate aggressive edge, particularly if your competition can not provide the exact payment selections. Current shoppers, meanwhile, will appreciate obtaining extra flexibility about payments and will be extra probable to keep on being loyal shoppers.

Problems of Extending Credit

Choices to prolong credit history often have some quantity of possibility. Extending credit history to extra shoppers raises the chance of late-paying shoppers or shoppers who can not pay, which can put the brakes on your dollars movement. It may well also final result in greater charges down the street, requiring you to establish up your collections infrastructure (or else pay a 3rd get together) to pursue payments from shoppers that come across on their own unwilling or unable to pay. It may possibly also lead to greater charges by means of elevated uncollectable balances that subsequently require to be prepared off.

Know Your Buyers

When it will come to decisions about extending credit history, shopper expertise and interactions, sturdy policies, and finance instruments and technologies are all keys to results. Mainly because of the do the job that they have out, some industries like banking and some main firms like Cargill leverage sophisticated analytics applications and workflow instruments to establish whether to prolong or withhold credit history. And undoubtedly, providers that present client or organization-to-organization credit history scores are important instruments, particularly when evaluating new shoppers. Examining current customers’ payment histories and behaviors can also support present a clearer photograph of shopper behavior styles and whether it is truly worth the possibility to give them a little bit longer to pay.

There is also a relational element to some credit history decisions that just cannot be disregarded. Specially for a company’s most strategic and mutually-helpful interactions, it may well be truly worth compromising on credit history terms. Your organization and its workforce are the priority, but holding your most essential and important shoppers may possibly make it truly worth accepting slower payments about time.

In an excellent planet, your company would get compensated at the position of sale for just about every solution or service it sells. Even now, the actuality is unlikely to match this excellent — particularly in an economic system that stays battered by a pandemic. Specifically if you’re in an field where credit history is a needed section of carrying out organization, meticulously weighing the pros and downsides and building sensible policies will support reduce the possibility and support your company maximize the probable possibility that will come from obtaining extra shoppers on credit history.

Perry D. Wiggins, CPA, is CFO, secretary, and treasurer for APQC, a nonprofit benchmarking and very best tactics study firm based in Houston, Texas.