Finance masters graduates brace for an uncertain market

As pieces of the world slowly and gradually arise from lockdown, Kelly Chaaya is planning to begin her internship at a world-wide lender. But the masters in finance college student at HEC Paris will not be likely into Citibank’s London place of work — alternatively her do the job will be performed remotely.

In spite of the unconventional instances and financial uncertainty induced by the coronavirus pandemic, Ms Chaaya is optimistic about her prospective customers in the finance industry. “There will be some changes . . . but it is not likely to be as impacted as other sectors, this sort of as the media,” she suggests.

But individuals finishing their MiF programs now sign up for numerous other graduates who will have the challenging endeavor of creating a career in the course of a period of time of world-wide financial shock.

Sentiment about internships and job offers is blended among the company universities and pupils, so it is challenging to predict how the landscape for MiF graduates will shift around the coming months. Broadly, even though, there is a emotion that the finance industry will keep continuous.

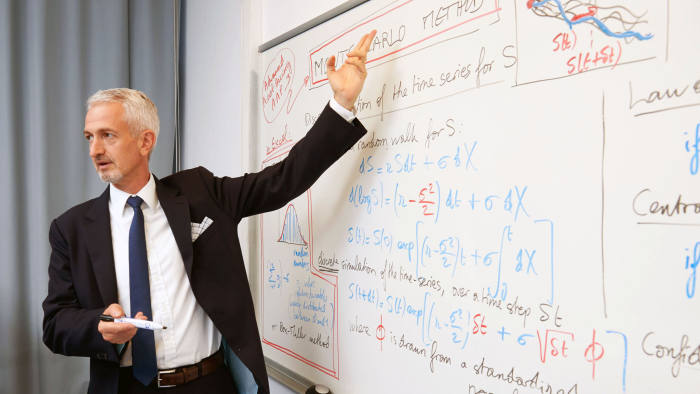

Olivier Bossard, executive director of HEC’s MiF, suggests the only factual observation he can make for the company school’s graduates is that corporations are delaying or shortening summer months internships. “The big financial commitment banking companies are essentially enjoying a pretty fair-participate in activity with our graduates,” he suggests.

When it comes to job offers, individuals using the services of from HEC are “still absolutely committed” to just take persons, Prof Bossard provides. “Only three companies so significantly have acknowledged that they would not be equipped to honour their commitments.”

Overall he does not expect big alterations with financial commitment banking companies. He points out that the pandemic has established a disaster in the genuine financial state. “Relative to 2008, the banking companies are in a a great deal far better condition: a lot more liquidity, far better money adequacy, dangers are a lot more beneath command,” he suggests. Although items are alarming, “it is not, at minimum for now, a extraordinary circumstance specific to banking companies, or the economical sector.” Prof Bossard is a lot more concerned about the consulting sector, which he thinks could be hit by charge-conserving measures.

Anna Purchas, head of persons at qualified expert services business KPMG, suggests that at this stage it is challenging to predict how the positions market in consulting will shift for MiF graduates. But “some parts of the company, this sort of as restructuring, are likely to be pretty, pretty very hot,” she suggests, “and that is an spot where a strong analytical qualifications and knowing of company is exceptionally helpful”.

The enterprise has cancelled its summer months internship plan as it did not imagine it could provide its candidates the greatest working experience, but some of individuals owing to just take element have been presented places for the 2021 graduate ingestion.

In the US, however, Peter Cappelli, director of the Centre for Human Means at Wharton Enterprise School, suggests internships are staying rescinded. He provides that, though the corporations cancelling placements have not finalised conclusions on job offers, “my guess is that individuals will be rescinded as well”.

Even so, Prof Cappelli thinks the finance sector could be considerably less impacted than other individuals “because finance and investing goes on”.

Christian Dummett, head of London Enterprise School’s career centre, suggests the job market is often changing. In finance, asset lessons and subsectors fall in and out of favour, though engineering has disrupted conventional organizations. “Crises can speed up this,” he suggests. But he thinks that “coronavirus is a lot more probable to influence the way we do the job — from property, considerably less vacation — fairly than roles per se.”

Given that MiF graduates encounter uncertainty and could be competing from increased figures of pupils for much less positions, what competencies do they need to have to guarantee a prolonged-term career and how can they acquire them though finding out?

Casper Quint, an MiF college student owing to graduate later this 12 months from London Enterprise School, recommends that as soon as pupils get started their programme, they should really begin to acquire an plan of what they want to do. “Investment banking has a pretty unique recruitment procedure from, for case in point, fintech,” he suggests.

LBS’s career centre assisted him approach his strategy, though he also suggests pupils should really “reach out to alumni”.

Ms Purchas thinks a core talent is demonstrating adaptability. Graduates need to have to preserve an eye on where the market is rising and where it is contracting, and imagine about how they can placement themselves.

“When I imagine about my career, it has been a portfolio career,” she suggests. “I imagine that seriously is the way for persons to imagine about their careers. There will be phases. You can learn from every single [1], make on it and transfer across.”

She provides that, though they are performing their MiF programme, pupils should really also be networking and understanding from their friends, so they can reveal that they can thrive among the persons from diverse backgrounds.

Ms Chaaya suggests that though no 1 expects MiF pupils to be geniuses, they do need to have to know a whole lot about the technical facets, as perfectly as curious — “ask questions”, she advises. When interviews get started to grow to be discussions fairly than emotion like a grilling, the chance of achievement raises.

In spite of the prospect of a tough period of time forward, she recommends finance to any individual fascinated in doing the job with figures. There is often do the job, she suggests, “in the fantastic periods and negative times”.