Federal Reserve Board – Federal Reserve Board releases hypothetical scenarios for second round of bank stress tests

The Federal Reserve Board on Thursday released its hypothetical situations for a next round of financial institution tension exams. Before this 12 months, the Board’s initial round of tension exams located that substantial banks were being perfectly capitalized under a range of hypothetical occasions. An extra round of tension exams is getting carried out thanks to the ongoing uncertainty from the COVID occasion.

Big banks will be analyzed against two situations featuring intense recessions to evaluate their resiliency under a range of outcomes. The Board will launch business-distinct results from banks’ efficiency under the two situations by the close of this 12 months.

The Board’s tension exams assistance ensure that substantial banks are able to lend to households and enterprises even in a intense recession. The physical exercise evaluates the resilience of substantial banks by estimating their mortgage losses and capital levels—which deliver a cushion against losses—under hypothetical recession situations more than nine quarters into the future.

“The Fed’s tension exams previously this 12 months showed the energy of substantial banks under a lot of different situations,” Vice Chair Randal K. Quarles claimed. “While the economic system has improved materially more than the previous quarter, uncertainty more than the program of the subsequent couple quarters remains unusually higher, and these two extra exams will deliver far more info on the resiliency of substantial banks.”

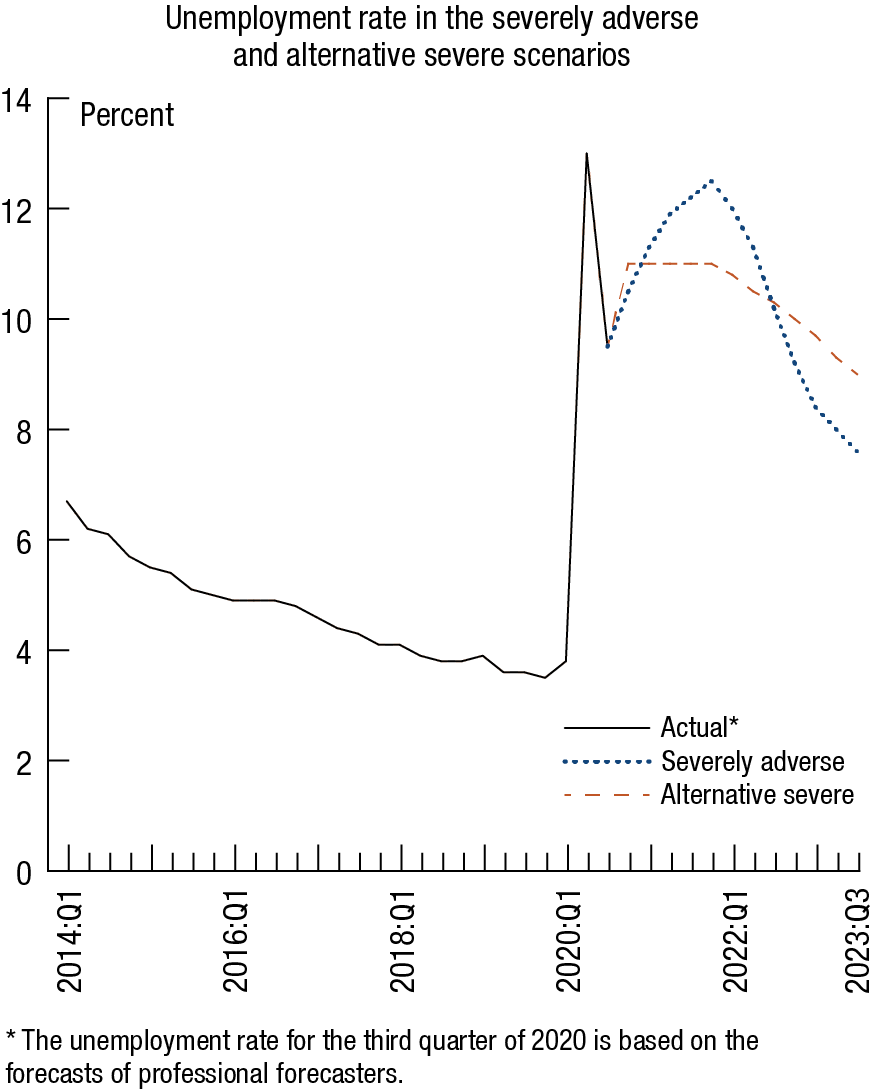

The two hypothetical recessions in the situations feature intense international downturns with substantial tension in economic markets. The initial scenario—the “seriously adverse”—features the unemployment charge peaking at 12.five percent at the close of 2021 and then declining to about seven.five percent by the close of the state of affairs. Gross domestic products declines about 3 percent from the third quarter of 2020 as a result of the fourth quarter of 2021. The state of affairs also characteristics a sharp slowdown abroad.

The next scenario—the “alternative intense”—features an unemployment charge that peaks at eleven percent by the close of 2020 but stays elevated and only declines to nine percent by the close of the state of affairs. Gross domestic products declines about 2.five percent from the third to the fourth quarter of 2020. The chart under reveals the path of the unemployment charge for each and every state of affairs.

The two situations also involve a international current market shock part that will be utilized to banks with substantial trading operations. People banks, as perfectly as certain banks with substantial processing operations, will also be expected to include the default of their major counterparty. A desk under reveals the parts that utilize to each and every business.

The situations are not forecasts and are noticeably far more intense than most existing baseline projections for the path of the U.S. economic system under the tension screening time period. They are developed to evaluate the energy of substantial banks throughout hypothetical recessions, which is particularly ideal in a time period of uncertainty. Each and every state of affairs includes 28 variables masking domestic and global economic exercise.

In June, the Board released the results of its yearly tension exams and extra analyses, which located that all substantial banks were being adequately capitalized. Nevertheless, in light-weight of the heightened economic uncertainty, the Board expected banks to choose several steps to protect their capital amounts in the third quarter of this 12 months. The Board will announce by the close of September no matter whether all those steps to protect capital will be extended into the fourth quarter.

| Financial institution | Matter to international current market shock | Matter to counterparty default |

|---|---|---|

| Ally Economical Inc. | ||

| American Categorical Firm | ||

| Financial institution of The usa Company | X | X |

| The Financial institution of New York Mellon Company | X | |

| Barclays US LLC | X | X |

| BMO Economical Corp. | ||

| BNP Paribas United states of america, Inc. | ||

| Money 1 Economical Company | ||

| Citigroup Inc. | X | X |

| Citizens Economical Team, Inc. | ||

| Credit Suisse Holdings (United states of america), Inc. | X | X |

| DB United states of america Company | X | X |

| Discover Economical Companies | ||

| DWS United states of america Company | ||

| Fifth Third Bancorp | ||

| The Goldman Sachs Team, Inc. | X | X |

| HSBC North The usa Holdings Inc. | X | X |

| Huntington Bancshares Included | ||

| JPMorgan Chase & Co. | X | X |

| KeyCorp | ||

| M&T Financial institution Company | ||

| Morgan Stanley | X | X |

| MUFG Americas Holdings Company | ||

| Northern Believe in Company | ||

| The PNC Economical Companies Team, Inc. | ||

| RBC US Team Holdings LLC | ||

| Locations Economical Company | ||

| Santander Holdings United states of america, Inc. | ||

| State Avenue Company | X | |

| TD Team US Holdings LLC | ||

| Truist Economical Company | ||

| UBS Americas Keeping LLC | X | X |

| U.S. Bancorp | ||

| Wells Fargo & Firm | X | X |

For media inquiries, connect with 202-452-2955